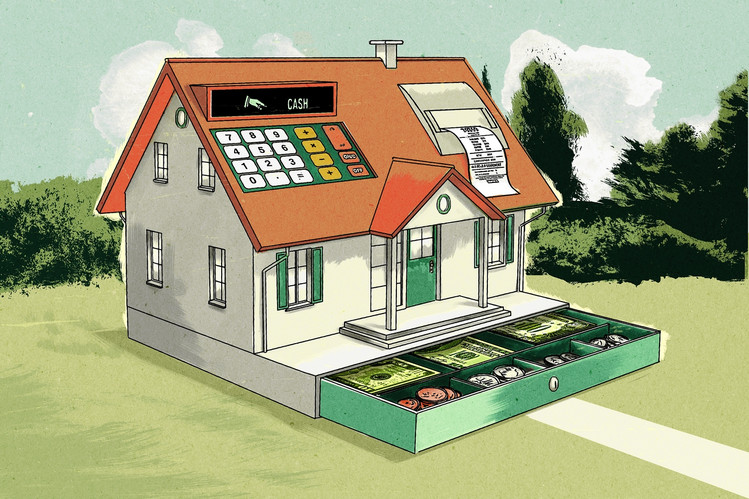

What is a

'Home-Equity Loan'

A consumer loan secured by a second mortgage,

allowing home owners to borrow against their equity in the home. The loan is

based on the difference between the homeowner's equity and the home's Current

market value. The mortgage also

provides collateral for an asset-backed security issued by the lender

and sometimes tax deductible interest payments for the borrower.

Also known as "equity loan" or "second mortgage".

BREAKING DOWN 'Home-Equity Loan'

A home-equity loan is basically a line of credit secured by your home. When the line of credit is drawn down, the financial institution providing it places a second mortgage loan on your home until the loan is paid off, after which the you can use the loan to finance other purchases. However, if the loan is not paid off, your home could be sold to pay off the remaining debt. Interest rates on such loans are usually adjustable rather than fixed and lower than standard second mortgages or credit cards.

Home Equity Loan or

Line or Credit?

Should you get a home equity loan or a home equity line of credit, known as a HELOC? With a home equity loan, you get a lump sum. A HELOC provides you a revolving credit line, much like a credit card.